IDENTITY THEFT INFORMATION

Important First Steps:

File a police report in your local city

Retain the police case number for future reference, you may need it to prove you filed a report.

Block impacted accounts

Change any passwords on accounts that may be compromised

Under U.S. law you are entitled to one free credit report annually from each of the three major credit reporting bureaus. To order your free credit report, visit www.annualcreditreport.com or call, toll-free, 1-877-322-8228.

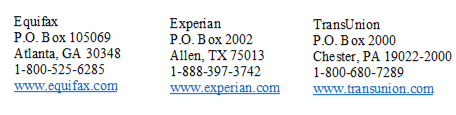

You may also contact the three major credit bureaus directly to request a free copy of your credit report. At no charge, you can also have these credit bureaus place a “fraud alert” on your file that alerts creditors to take additional steps to verify your identity prior to granting credit in your name.

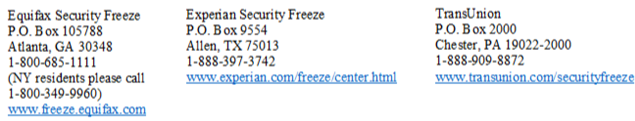

6. You may also place a security freeze on your credit reports. A security freeze prohibits a credit bureau from releasing any information from a consumer’s credit report without the consumer’s written authorization.

However, please be advised that placing a security freeze on your credit report may delay, interfere with, or prevent the timely approval of any requests you make for new loans, credit, mortgages, employment, housing, or other services. If you have been a victim of identity theft, and you provide the credit bureau with a valid police report, it cannot charge you to place, lift or remove a security freeze. In all other cases, a credit bureau may charge you a fee to place, temporarily lift, or permanently remove a security freeze. You will need to place a security freeze separately with each of the three major credit bureaus listed above if you wish to place a freeze on all of your credit files. To find out more on how to place a security freeze, you can use the following contact information:

7. You can further educate yourself regarding identity theft, fraud alerts, and the steps you can take to protect yourself, by contacting the Federal Trade Commission or your state Attorney General. The Federal Trade Commission can be reached at: 600 Pennsylvania Avenue NW, Washington, DC 20580; www.identitytheft.gov; 1-877-ID-THEFT (1-877-438-4338); and TTY: 1-866-653-4261.

The Federal Trade Commission also encourages those who discover that their information has been misused to file a complaint with them.

If you have further questions regarding fraud, please contact the credit union at 509-327-3244. We are happy to answer your identity theft questions.